Good For Your and Your Excellent Credit. Congratulations On Your Hard Work!

What is the best credit card for excellent credit? In truth, there is no one-size-fits-all card; the best credit card for you depends on your goals and lifestyle. That’s why the experts at CreditCards.com have compiled a list of the best cards in each major category, from cash back and travel rewards to balance transfers and more. Explore our top picks from our partners and find the best credit card for you.

- Take advantage of your excellent credit to get the best rates and rewards

- Enjoy low rates and rewards for everyday spending

- Excellent credit can lead to higher credit lines

- Earn cash back, points or miles to redeem for travel, gift cards or cash rewards

- Bonus offers – up to 50,000 points or miles

- Terms vary by partner. Please see individual application for product terms and conditions.

- Clicking Apply Now will take you to CreditSoup.com to compare Credit Cards for Excellent Credit from participating partners

- Patented brushed stainless steel front and carbon back—weighing 22 grams.

- 2% value for airfare redemptions with no blackout dates or seat restrictions.

- 1% value for cash back redemptions.

- 24/7 Luxury Card Concierge®—Available by phone, email, and live mobile chat.

- Exclusive Luxury Card Travel® benefits (e.g., amenities, room upgrades and complimentary food and beverages).

- Members-only LUXURY MAGAZINE®.

- Cell Phone Protection, Lyft credits, Postmates discounts, Fandango perks and more.

- Annual fee: $195 ($95 for each Authorized User).

- Earn one point for every one dollar spent.

- Terms and conditions apply.

- Enjoy Priority Pass Membership on us (Lifetime value worth $99)

- Earn 3% cash back on Travel, 2% on Restaurants, & 1% cash back on all other purchases automatically.

- No Annual Fee, No Foreign Transaction Fees, and No Late Fee on first late payment.

- Cell Phone Protection up to $600 when you pay your cell phone bill with Deserve EDU Mastercard along with Mastercard Platinum Benefits

- More Perks You Deserve: Mint Mobile: Three Months of Text + Talk! Use your Deserve Mastercard to sign up and pay for any Mint Mobile wireless plan and you’ll get a $45 statement credit. __Lemonade Insurance Rebate __- Pay for 3 consecutive monthly insurance from Lemonade with your Deserve card and get a $10 statement credit. Feather Furniture Rental – Use your Deserve card to rent furniture from Feather and enter promo code DESERVE100 to get $100 off your first month’s rental.

- Start/Stop card use + stay current with your FICO score with the Deserve mobile app

- Start building your credit responsibly and enjoy the perks for good credit

- No Deposit Required

- Enjoy Amazon Student Prime Membership on us for a year, must be a student to qualify.

- Earn 1% cash back on all purchases automatically.

- No Social Security Number required for International Students and no credit history required.

- No Annual Fee, No Foreign Transaction Fees, and No Late Fee on first late payment.

- Cell Phone Protection up to $600 when you pay your cell phone bill with Deserve EDU Mastercard along with Mastercard Platinum Benefits

- More Perks You Deserve: Mint Mobile: Three Months of Text + Talk! Use your Deserve Mastercard to sign up and pay for any Mint Mobile wireless plan and you’ll get a $45 statement credit. Lemonade Insurance Rebate – Pay for 3 consecutive monthly insurance from Lemonade with your Deserve card and get a $10 statement credit. Feather Furniture Rental – Use your Deserve card to rent furniture from Feather and enter promo code DESERVE100 to get $100 off your first month’s rental.

- Start/Stop card use + stay current with your FICO score with the Deserve mobile app.

- Start building credit responsibly and enjoy the perks of being a student

- No Deposit Required.

- Patented 24K-gold-plated stainless steel front and carbon back—weighing 22 grams.

- 2% value for airfare redemptions with no blackout dates or seat restrictions.

- 2% value for cash back redemptions.

- 24/7 Luxury Card Concierge®-available by phone, email, and live mobile chat.

- Exclusive Luxury Card Travel® benefits (e.g., amenities, room upgrades and complimentary food and beverages).

- Up to $200 annual airline credit and $100 Global Entry application fee credit.

- Cell Phone Protection, Lyft credits, Postmates discounts, Fandango perks and more.

- Annual fee: $995 ($295 for each Authorized User).

- Earn one point for every one dollar spent.

- Terms and conditions apply.

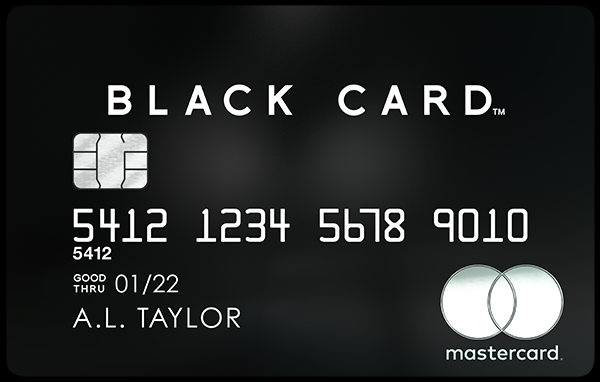

- Patented black PVD metal card—weighing 22 grams.

- 2% value for airfare redemptions with no blackout dates or seat restrictions.

- 1.5% value for cash back redemptions.

- 24/7 Luxury Card Concierge®—available by phone, email and live mobile chat.

- Exclusive Luxury Card Travel® benefits (e.g., amenities, room upgrades and complimentary food and beverages).

- Up to $100 annual airline credit and $100 Global Entry and TSA Pre-Check application fee credit.

- Cell Phone Protection, Lyft credits, Postmates discounts, Fandango perks and more.

- Annual fee: $495 ($195 for each Authorized User).

- Earn one point for every one dollar spent.

- Terms and conditions apply.