Gun friendly credit card processors

Are YOU Struggling with merchant account issues like freezes, holds, or shutdowns? Get the fastest, safest way to process payments with Creditly. We are a gun-friendly credit card company.

We’ve processed transactions for businesses offering firearms and gun accessories. If you are a manufacturer or retailer, give us a call and let us know to help answer your questions.

- Chargeback Mitigation

- Recurring Billing

- Reduce Decline Rates

- Fraud Protection

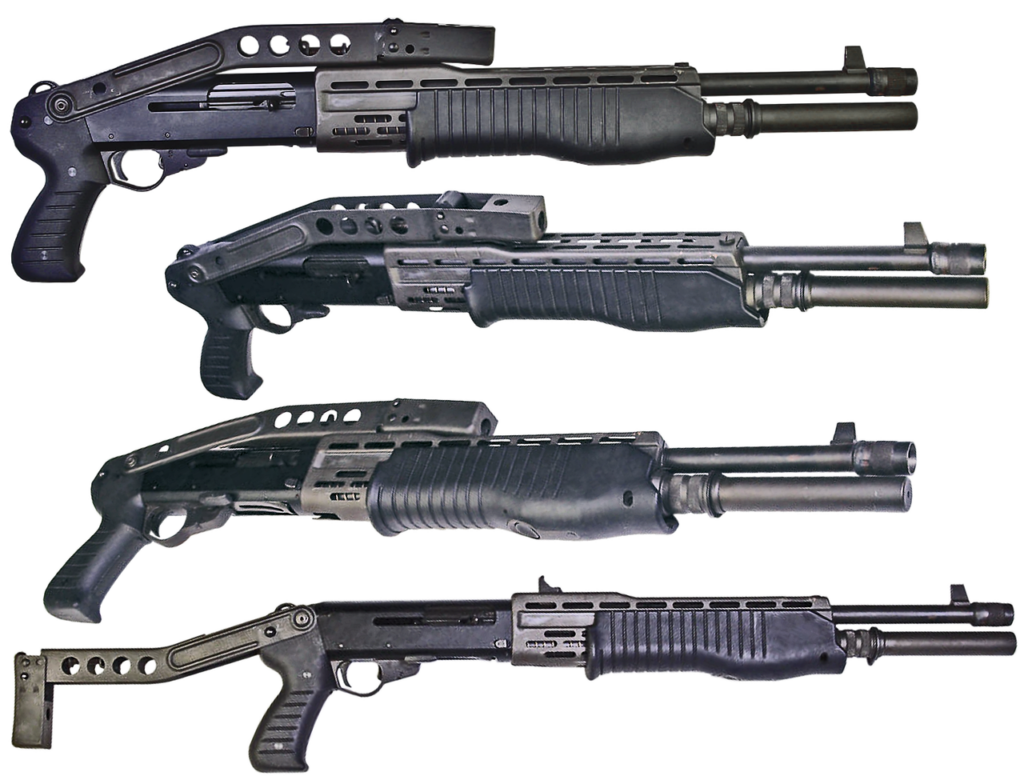

Accept Payments – Guns, Gun Parts, Accesories

If your gun shops merchant account was shut down today and you could no longer accept credit cards, how long could you keep the doors open?

Everyday basic payment aggregators and companies like Stripe, PayPal, Square, Shopify, etc. Shut down thousands of accounts.

It’s not a matter of IF you’ll get shut down, but WHEN…

If your provider held your money for 90 days would you survive?

If they placed a 10% hold on your account, could you make payroll?

How do you get gun-friendly credit card processing? Let’s get you started, it’s time to upgrade to Creditly.

Creditly helped us get access to a payment processor when others could not. They were super helpful and got us up and running faster than expected. Highly recommended!

Joseph Dubois

Co-FounderWe needed access to multiple processors, and Creditly delivered. It's good to know we have a partner that will stand behind us as we grow and expand our locations.

Jody Martinez

SAS & TravelOur high risk business needed help after Stipe held up payments. Creditly got us approved. I'll never go back to using Stripe or PayPal.

Neil Oliver

Ecommerce HealthSee How Creditly Can Help With Your Merchant Account, Check Out Our Features:

Transaction Routing – We’ll automatically route your transactions across multiple accounts. That way if anything ever happens to one, your others are still up and running.

White Glove Service – You’ll have a dedicated point of contact that you can reach any time you need them.

Decline Recovery – We’ll help you improve your approval ratios and reduce decline rates. That way, you put more cash back in your pocket and process more payments.

Chargeback Mitigation – Stop chargebacks before they begin with. our chargeback alert system. Greatly lower account issues and improve customer satisfaction.

Hosted Checkout – Quickly create checkout links and landing pages with a few clicks. Email them, DM them, or text them to your clients for payments on the fly.

Recurring Billing – Built-in recurring billing for subscription purchases with multiple payment options available

Mobile Payments – Process payments on the go with our easy to use mobile payment solution

250+ Integrations – Integration to nearly every shopping cart, plus we integrate to most apps and software. If you need something specific, our in-house development team will make it happen.

Banking For Nearly Every Vertical – We offer merchant accounts for almost every vertical, including high risk merchants and much more. Get approved today.

Unlimited High Ticket – Worry free processing of high ticket transactions and high volume.

GUN FRIENDLY PAYMENT PROCESSOR

Holding space as a business in the gun and ammunition industry comes with a unique set of challenges. Finding a reliable gun-friendly credit card processing option is one of the most important. Like other regulated industries, firearms sellers need a credit card processor that understands their business and how to support the company’s particular needs.

Unfortunately, most credit card processors are not designed to provide the high risk merchant accounts needed to accept payments for guns and gun accessories. Creditly has helped many entrepreneurs in the firearms and ammunition industry to obtain secure, reliable processing designed for their specific business model.

WHY ARE GUN & FIREARMS DEALERS CONSIDERED HIGH-RISK?

Credit card processors determine whether a particular application is high risk based primarily on the industry’s processing history. Industry norms like restrictive laws, high chargebacks, frequent fraud, or high average prices can all play a part, even if the specific business in question has a very clean operating history.

Because of this, companies that engage in the sale of guns, ammunition, and related products are automatically considered high risk by processors. Here are some of the specific factors that affect processing risk for the firearms industry:

GUN LAWS CAN BE COMPLICATED

Due to federal and state regulations on the sale and transfer of guns and ammunition, many processors simply choose not to work with businesses in this industry. Among other things, businesses in this industry must keep up to date on strict regulations regarding the vetting of customers, registration of sales, and transfer or delivery of products. To be eligible for a firearms merchant account, the applicant must be a Federal Firearms Licensee (FFL) with a license that matches the types of products they sell (and/or manufacture).

LEGAL & FINANCIAL LIABILITY

Not only do laws vary by state, but there are also frequent changes to the legislation. Often, these changes are influenced by current events involving gun violence. Some processors refuse to enter the firearms space simply to avoid entangling their reputation with the polarizing “hot button” issues of gun control and Second Amendment rights activism. Those processors who are gun-friendly often limit the types of guns or related products they will permit to be sold. For instance, explosive targets or “destructive devices” may not be permitted.

FRAUD AND CHARGEBACKS

Gun-friendly credit card processors know that most businesses selling firearms and related products are diligent in verifying the identity and eligibility of their customers to legally purchase these items. Sadly, fraudsters attempt illegal purchases on stolen credit cards or with stolen identities every day.

When these crimes are successful, guns often end up in the hands of people who don’t have legal access to them otherwise. This can reflect poorly on the seller, even if they have done their proper due diligence. This fraudulent activity can also increase chargebacks when cardholders discover unauthorized purchases.

BENEFITS OF GUN-FRIENDLY CREDIT CARD PROCESSORS

Firearms business owners know that working with a gun-friendly credit card processor comes with a healthy dose of confidence that their payments won’t be interrupted. The right payment processor is aware of the risk of events like those above and is prepared for the possibility of them occurring. Because of this, they can offer processing accounts with greater stability.

REDUCED RISK OF FROZEN ACCOUNTS OR INACCESSIBLE FUNDS

Standard payment processors only have one option to prevent loss when things go sideways with a high-risk situation. They freeze or even close the processing account without warning to limit their liability. Most processors won’t even accept applications for high-risk merchant accounts. This makes the chance of getting a gun-friendly processing account very low if you’re not working with the right provider.

NO LOSS OF POTENTIAL SALES

If a processing account does get frozen, the business has no choice except to put potential credit card sales on hold while they work to get the freeze removed or a new account opened. Working with a gun-friendly processor from the beginning saves this headache from ever occurring in the first place.

WHAT Creditly PROVIDES: MERCHANT ACCOUNTS

Creditly is partnered with an extensive network of credit card processors.

We know which of them are gun-friendly and what their guidelines and limitations are so you get paired with the best processor for your business.

Whether your firearm sales are captured online, in person at a shop, or on the road at gun shows, we can get you set up with the right equipment and integrations to make your payment processing easy and reliable.

WHAT FIREARM BUSINESSES DO WE WORK WITH?

At Creditly, we know that even gun-friendly processors have different specialties. We also know which ones are best suited to your specific business model. Whether you are exclusively a gun broker or your company also sells ammunition and accessories, military and tactical gear, or operates as a second-hand retailer like a pawn shop, we can help you get set up with a processor that’s right for you.

We can also facilitate accounts for peripheral businesses like gun training services, shooting ranges, and firearms information products. Whatever your niche, Creditly can help find a high-risk merchant account provider that wants to work with your business and provide all the resources to meet your high-risk credit card processing needs.

PAYMENT PROCESSING FEATURES AND INTEGRATIONS

At Creditly, we use processing providers who take the time to get to know the businesses they work with through underwriting. During this stage of account setup, they review documents and information about the company and its ownership to establish a baseline knowledge of the business. This ensures that the account is set up in the right way with the right features to provide a more stable credit card processing experience for your business.

Some features you can expect with Creditly include:

- An industry-leading gateway for online sales

- Quality equipment for in-person, online, and on-the-go payments

- Personal support from our team of experts

- Chargeback monitoring services

- Fraud Protection Tools

- Competitive rates

HOW TO GET A MERCHANT ACCOUNT

The first step on your path to a new merchant account is to start Creditly’s easy merchant application. This ensures we can eliminate the headache of filling out one application after another, hoping to find a high-risk, gun-friendly processor who “gets” your business model.

Instead, we will identify the right processor and account to ensure you are working with the best payment provider for your company – one who wants to work with you and knows the nuances of your industry. We can get you set up in as little as 2 DAYS! If you would rather chat with someone to find out more, call us at (877) 307-7711.

*TIp: This is easier because we can help you with your application!

AFTER YOUR MERCHANT ACCOUNT IS SET UP

After we get you set up with your first merchant account, we’ll help you monitor your processing trends to ensure stable payment processing. For instance, even though Creditly takes all the precautions to prevent you from experiencing an interruption in your payment processing, once your sales volume reaches $250,000 a year, we’ll recommend getting a second account to help protect your business finances.

Having an additional merchant account that is already up, and running and processing payments gives you the freedom to pivot your payments should a problem ever occur with one of your accounts.

All of this may seem like a lot of complicated work, and it would be if you were handling it on your own. However, at Creditly, we manage all of this for you. It’s our goal to help make things easy. We’ll even assign you a Merchant Success team who will monitor your merchant accounts for you and serve as your single point of contact for all of your merchant processing needs.

THE Creditly Merchant Account EXPERIENCE

At Creditly your journey will begin with your application, which we use to collect information about you and your business to match you with the right merchant account provider.

From there you will be connected with your New Client Specialist who will help you complete this application and will be your contact to answer all of your questions.

Once we have assessed your business model, you will be classified as a Gold, Platinum, or Diamond merchant based on your unique payment processing needs.

You will be introduced to your Certified Payment Specialist who will be your point of contact throughout the account setup stage. They’ll assemble your Merchant Success team so you’ll know who to contact for all of your payment processing needs.

When you contact us, you are talking to someone that you know and who knows you and your business. Our team will monitor your accounts and perform annual merchant account reviews. They’ll be available if you have questions and will reach out to alert you if something requires your attention.

What Creditly Can Do For You...

or call us at: (877) 307-7711 Get Set-up with a Merchant Account.»

Creditly offers Gun friendly Credit Card Processors FAQ

What is a gun-friendly credit card processor?

A gun-friendly credit card processor is a type of merchant services provider that works with businesses in the firearms and ammunition industry. They will be able to provide merchant account to process credit card payment

Why do gun businesses need a specific credit card processor?

Due to the nature of firearms and ammunition, businesses in this industry may be considered high-risk by traditional merchant service providers. Gun-friendly credit card processors specifically work with businesses in this industry and may be more willing to provide merchant services.

Are there any additional fees associated with gun-friendly credit card processors?

There may be additional fees associated with a gun-friendly credit card processors, such as higher processing fees or a higher monthly account fee, to cover the additional risk associated with the industry. It’s important to carefully review the terms and fees of any merchant account before signing up to ensure that you fully understand the costs involved.

Are there any restrictions on what types of firearms or ammunition can be sold using a gun-friendly credit card processor?

Yes, there may be restrictions on what types of firearms or ammunition can be sold using a gun-friendly credit card processor. These restrictions may vary depending on the merchant services provider, as well as the laws and regulations of the jurisdiction in which the business operates. It’s important to check with the credit card processor on their specific policies and restrictions.

Are there any security measures that gun-friendly credit card processors put in place to protect customer data?

Yes, gun-friendly credit card processors generally use several types of security measures to protect sensitive customer information, such as SSL encryption to protect data transmitted over the internet, PCI compliance to secure data stored on the merchant’s server, and fraud detection and prevention tools to reduce the risk of fraudulent transactions.

Trust Creditly

Creditly Merchant Accounts FAQ

If you want to know more about payments, pricing, or solutions to problems you are experiencing, we are always ready to help you.

What industries does Creditly work with?

Creditly offers access to high risk payment processing, but we also work with mid-risk and low-risk companies.

Here is a short list of some business verticals we service:

- Antiques & Collectibles

- Apparel & Clothing

- Bad Credit

- Bus Lines

- Cannabis Support Businesses

- Caterers

- CBD Oil & CBD Products

- Continuity Products and Subscription Boxes

- Credit Repair

- Credit Monitoring

- Debt Collection

- Digital Streaming

- Document Preparation

- Fantasy Sports

- Firearms & Ammunition

- Furniture & Home Furnishings

- Health & Beauty

- Hotels & Lodging

- Insurance / Warranty

- Legal Services

- Magazine Subscriptions

- Medical Billing & Coding

- Medical Supplies

- Membership & Recurring Billing

- MLM Companies

- Transportation & Moving

- Non-Profit

- Nutraceuticals

- Pawnbrokers & Pawn Shops

- Pet Products

- Precious Metals

- Property Management

- SaaS Companies

- Seminars & Coaching

- SEO / SEM / Ad Agency

- Smoking Accessories

- Sports Betting

- Survivalist & Tactical Gear

- Telemedicine

- Tobacco & Cigar

- Travel & Timeshare

- Vape / e-Cig / eJuice

- Veterinarians

- Web Design & Development

Why is my business considered high risk?

“High Risk” is a banking industry term. It’s important to note that there are many business models that are seemingly low risk, but fall into the high risk category.

There is nothing wrong with being considered high risk and there are many factors that contribute to risk.

When a consumer buys an item with a credit card, they are given 6 months from the date of receiving the item to dispute the charge.

If your business is no longer operating, who do you think has to refund that money? The processor. This is where risk is created.

Certain businesses, marketing models, and industries have a higher rate of chargebacks, where they get labeled as high risk.

Even if your business is perfect, has never had a chargeback, and operates 100% “by the books”, you could be labeled high risk if you’re business or industry falls into a high risk category.

There are 3 main reasons a business can be considered high risk.

- The business has a greater chance of chargebacks occurring

- The business model may be new or legally regulated

- The business accepts a high number of card not present transactions (over the phone, email, eCommerce)

Do you provide merchant account services outside of the USA?

At this time Creditly offers merchant account services for the USA and Canada. We are always working to expand our areas of processing and hope to serve a greater area in the near future.

Can my startup or new business be approved?

We have worked with many new brands and start-ups to get them approved and running. However, banks like to see a long history of transactions and an established history with a merchant before approving them.

But, that does not mean we can’t get you approved. Reach out to us today and we will walk you through your options.

How long does it take to get approved for a merchant account?

Once all of the necessary documents have been received, it typically takes 1-4 days to get approved.

Occasionally accounts can be approved in less than 24 hours, our team will work as quickly as possible to get your account up and running.